Back to Notifications

RRB

Reserve Bank of India Office Attendant Recruitment 2026: Detailed Analysis

Posted on January 23, 2026

Expires: February 4, 2026

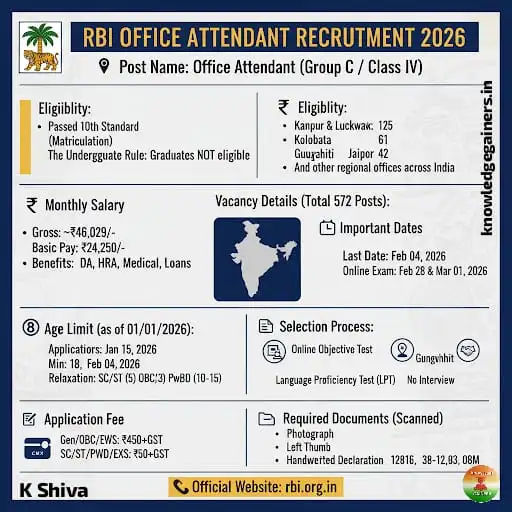

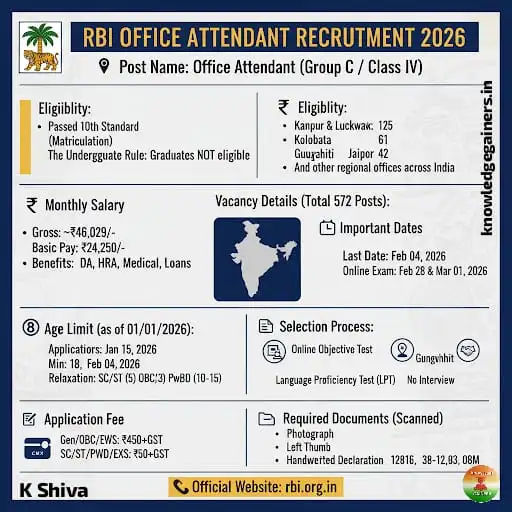

The Reserve Bank of India (RBI), as the cornerstone of the nation’s financial architecture, maintains an organizational structure that necessitates a robust and diversely skilled workforce. Beyond the high-level policy analysts and economic researchers, the functional integrity of the Bank relies heavily on its support staff. The announcement of the 2026 recruitment for the post of Office Attendant, focusing on the Panel Year 2025, represents a significant institutional effort to revitalize its Group C cadre across 14 regional offices. This recruitment drive, involving 572 vacancies, is designed to integrate individuals who possess a fundamental secondary education while ensuring they are deeply rooted in the linguistic and cultural contexts of the regions they serve. This analysis examines the multi-faceted requirements, procedural protocols, and strategic implications of this recruitment cycle within the broader context of public sector employment in India.

Institutional Context and Job Requirement Overview

The role of an Office Attendant within the Reserve Bank of India is characterized as a Class IV or Group C position, providing foundational support to the Bank's diverse departments. While the designation might imply a purely manual scope of work, the modern RBI Office Attendant operates as a critical administrative auxiliary. The primary mandate of this role is to facilitate the seamless movement of documents, maintain the sanctity and organization of official records, and assist senior officers - including Grade A and Grade B executives - in their day-to-day operational requirements.

The daily responsibilities are geographically and departmentally specific but generally encompass several core functions. Attendants are responsible for the physical dispensation of files and dak (mail), ensuring that internal communication channels remain efficient. They manage the opening and closing of office premises, a task that involves a high degree of trust and adherence to security protocols. Furthermore, they handle routine office tasks such as photocopying, document sorting, and assisting in the logistical arrangements for official meetings and conferences. In an institution as rigorous as the RBI, the role demands a high level of discipline, punctuality, and an understanding of the Bank's internal hierarchy.

From a fiscal perspective, the position is highly sought after due to the competitive compensation package offered by the Bank. The initial gross salary is approximately ₹46,029/- per month, which includes a starting basic pay of ₹24,250/- along with various allowances. This remuneration level, combined with the job security inherent in the central bank of India, makes it one of the most attractive opportunities for individuals who have completed their 10th-standard education but are prohibited from being graduates at the time of application.

Chronology of the Recruitment Cycle

The 2026 recruitment cycle follows a compressed timeline, reflecting the RBI's transition toward more efficient, technology-driven hiring processes. The formal notification was disseminated on January 15, 2026, marking the immediate opening of the online application window. This timeline requires candidates to demonstrate a high degree of readiness, as the gap between the application deadline and the tentative examination dates is less than one month.

Event Description | Key Dates for the 2026 Cycle |

Release of Official Recruitment Notification | January 15, 2026 |

Opening of Online Registration and Application | January 15, 2026 |

Closing Date for Online Application Submission | February 04, 2026 |

Deadline for Payment of Online Examination Fees | February 04, 2026 |

Modification/Editing of Application Details | February 04, 2026 |

Tentative Release of Online Examination Call Letters | February 2026 |

Scheduled Dates for Online Computer-Based Test | February 28 & March 01, 2026 |

Expected Declaration of Written Results | March/April 2026 |

Commencement of Language Proficiency Test (LPT) | To be announced post-result |

The efficiency of this schedule indicates the Bank’s intent to minimize the duration of the recruitment panel's formation, ensuring that operational vacancies in regional offices are filled promptly to maintain institutional productivity.

Fiscal and Administrative Parameters: Application Fees

The application fee structure is designed to facilitate the administrative costs of a nationwide online examination while providing social equity through mandated concessions. The RBI utilizes a tiered system based on the candidate's social category.

Category | Fee Components | Total Amount Payable |

General / OBC / EWS Candidates | Examination Fee + Intimation Charges | ₹450/- (+ 18% GST Extra) |

SC / ST / PwBD / EXS Candidates | Intimation Charges Only | ₹50/- (+ 18% GST Extra) |

Staff Candidates (RBI Employees) | N/A | Exempted |

It is essential for applicants to note that the 18% Goods and Services Tax (GST) is levied over and above the base fee, a common practice in digital financial transactions initiated by public sector entities. The payment must be remitted exclusively through online channels, reflecting the Bank’s commitment to the Digital India initiative. Accepted modes include major credit and debit cards, internet banking portals, and Unified Payments Interface (UPI) systems.

Demographic Benchmarking: Age Limitations and Relaxations

The RBI establishes age criteria to ensure a long-term service commitment while providing employment opportunities to the younger segment of the population. As of the reference date of January 01, 2026, candidates must be between the ages of 18 and 25 years.

Core Age Eligibility

This age bracket signifies that a candidate must have been born no earlier than January 02, 2001, and no later than January 01, 2008. Both dates are inclusive in this calculation.

Strategic Age Relaxations

To ensure social inclusivity and acknowledge the diverse backgrounds of the Indian populace, the Bank provides upper age limit relaxations in accordance with central government guidelines.

Category | Maximum Age Relaxation | Final Upper Age Limit |

Scheduled Caste (SC) / Scheduled Tribe (ST) | 5 Years | 30 Years |

Other Backward Classes (OBC - Non-Creamy Layer) | 3 Years | 28 Years |

Persons with Benchmark Disabilities (PwBD) | 10 Years (Gen), 13 Years (OBC), 15 (SC/ST) | 35 to 40 Years |

Ex-Servicemen (EXS) | Service period + 3 years | 50 Years (Maximum) |

Widows / Divorced Women / Separated (not remarried) | 10 Years | 35 Years (40 for SC/ST) |

Candidates with prior RBI Experience | Actual years of experience | 3 Years (Maximum) |

The provision for women who are widowed or divorced serves as a social safety net, providing a pathway to economic independence for those in vulnerable domestic situations. Similarly, the relaxation for ex-servicemen recognizes their prior contribution to national security, facilitating their transition into civilian administrative roles.

Educational and Jurisdictional Eligibility

The eligibility criteria for the Office Attendant post are unique in their restrictive nature regarding higher education. While the Bank requires a minimum qualification, it strictly prohibits over-qualified candidates from participating in this specific recruitment tier.

The Minimum and Maximum Academic Threshold

Candidates must have successfully completed their 10th standard (SSC/Matriculation) from a recognized Board or Institute. However, a critical caveat of this recruitment is that the candidate must be an undergraduate as of January 01, 2026. Graduates or those possessing higher degrees are explicitly barred from applying. This "undergraduate rule" is a deliberate organizational strategy to prevent high turnover rates and ensure that the role is filled by individuals for whom this entry-level position represents a primary career opportunity rather than a temporary stopgap.

Jurisdictional and Domicile Compliance

Beyond academic credentials, the recruitment is strictly regional. A candidate must have passed the 10th standard from a school located within the regional jurisdiction of the recruiting office to which they are applying. Furthermore, the applicant must be a domicile of the State or Union Territory that falls under the jurisdiction of that specific recruitment office. This ensures that the staff is locally accessible and minimizes logistical challenges related to relocation for the Bank’s Group C workforce.

Linguistic Proficiency

Operational efficiency in regional offices requires staff who can communicate fluently with local visitors and handle documents in regional scripts. Therefore, candidates must be proficient—meaning they can read, write, speak, and understand—the local language of the state or region for which they are applying.

Spatial Distribution of Workforce: Detailed Vacancy Assessment

The 572 vacancies are distributed across 14 major urban centers, reflecting the varying administrative scales of the RBI’s regional operations. The distribution is further categorized to satisfy the reservation quotas for various social groups.

Recruiting Office | SC | ST | OBC | EWS | GEN/UR | Total | PwBD (A/B/C/D) | EX-I | EX-II |

Ahmedabad | 0 | 8 | 1 | 2 | 18 | 29 | 1/1/0/0 | 1 | 5 |

Bengaluru | 3 | 0 | 5 | 1 | 7 | 16 | 1/0/1/0 | 0 | 3 |

Bhopal | 0 | 3 | 0 | 0 | 1 | 4 | 0/1/0/1 | 0 | 0 |

Bhubaneswar | 6 | 8 | 4 | 3 | 15 | 36 | 0/0/2/0 | 1 | 6 |

Chandigarh | 1 | 0 | 0 | 0 | 1 | 2 | 0/0/0/0 | 0 | 0 |

Chennai | 0 | 0 | 8 | 0 | 1 | 9 | 0/0/0/0 | 0 | 0 |

Guwahati | 2 | 15 | 9 | 5 | 21 | 52 | 0/0/1/2 | 2 | 10 |

Hyderabad | 3 | 3 | 0 | 3 | 27 | 36 | 1/1/0/1 | 1 | 6 |

Jaipur | 8 | 5 | 5 | 4 | 20 | 42 | 2/0/0/1 | 1 | 8 |

Kanpur & Lucknow | 33 | 0 | 19 | 12 | 61 | 125 | 2/1/1/2 | 5 | 25 |

Kolkata | 23 | 1 | 21 | 9 | 36 | 90 | 0/1/1/1 | 4 | 18 |

Mumbai | 0 | 11 | 0 | 3 | 19 | 33 | 0/3/2/1 | 1 | 6 |

New Delhi | 4 | 0 | 11 | 6 | 40 | 61 | 1/2/1/0 | 2 | 12 |

Patna | 6 | 4 | 0 | 3 | 24 | 37 | 0/0/1/3 | 1 | 7 |

National Total | 89 | 58 | 83 | 51 | 291 | 572 | 8/10/10/12 | 19 | 106 |

The high vacancy counts in offices like Kanpur & Lucknow (125) and Kolkata (90) suggest a higher rate of historical vacancies or larger operational footprints in these regions. For ex-servicemen, the vacancies are split into two categories: EX-I (those with a disability resulting from military service) and EX-II (general ex-servicemen).

Methodological Approach to Selection

The RBI selection process for Office Attendants is a dual-tier mechanism that prioritizes cognitive aptitude and regional linguistic competence over complex technical knowledge. Significantly, there is no interview phase, ensuring a meritocratic selection based purely on test scores.

Phase I: Online Objective Test

The primary filter is a computer-based test comprising four equal sections. Candidates are allotted a composite time of 90 minutes to solve 120 questions.

Reasoning (30 Qs): Designed to test logical deduction, pattern recognition, and decision-making capabilities.

General English (30 Qs): Evaluates fundamental grammar, vocabulary, and basic comprehension. This is the only section that is not bilingual.

General Awareness (30 Qs): Focuses on national events, banking terminology, and static knowledge.

Numerical Ability (30 Qs): Assesses basic arithmetic speed and accuracy, equivalent to a 10th-standard difficulty level.

The marking scheme incorporates a penalty for guesswork: 0.25 marks are deducted for every wrong answer. Candidates must secure a minimum qualifying mark in each section and a cumulative total higher than the state-wise cut-off.

Phase II: Language Proficiency Test (LPT)

Candidates provisionally shortlisted from the online test must undergo a test in the regional language of the office they applied to. This test is qualifying in nature. Despite its qualifying status, failure to meet the LPT standards results in automatic disqualification, irrespective of the score achieved in the written exam. The test format typically involves reading a local newspaper, writing a short passage, and speaking in the language to a panel to confirm proficiency.

Subject-Wise Syllabus Analysis

Preparing for the RBI Office Attendant exam requires a focus on high-yield topics that appear frequently in banking recruitment for Group C posts.

Detailed Reasoning Syllabus

The reasoning section is intended to evaluate mental agility. Key topics include:

Seating Arrangement: Linear (single and double row) and circular (facing in/out).

Puzzles: Floor puzzles, box puzzles, and scheduling tasks.

Logical Deductions: Syllogism (Only/A Few concepts), Inequality (coded and direct), and Coding-Decoding.

Miscellaneous: Blood Relations (family trees), Direction Sense, and Alphanumeric Series.

Numerical Ability Syllabus

Speed is the decisive factor in this section. Candidates should master:

Calculative Basics: Simplification and Approximation, and Number Series (missing and wrong numbers).

Arithmetic: Percentages, Ratio and Proportion, Average, Profit and Loss, and Simple/Compound Interest.

Work and Motion: Time and Work, Pipe and Cistern, and Time-Speed-Distance.

Data Interpretation: Basic Tabular or Bar graphs.

General English Syllabus

Focusing on the 10th-standard level:

Reading Comprehension: Short story or fact-based passages with 5-7 questions.

Sentence Refinement: Error Detection (based on Subject-Verb Agreement, Prepositions, and Articles) and Sentence Improvement.

Vocabulary: Fill in the blanks (Single fillers) and Cloze Test.

General Awareness Syllabus

This is a vast section where consistency is key:

Banking Awareness: History of RBI, its subsidiary bodies (DICGC, BRBNMPL), and basic terms like Repo Rate and CRR.

Current Affairs: Appointments, Awards, Sports, and International Summits from the previous 6 months.

Static GK: National Parks, Wildlife Sanctuaries, Power Plants, and Currencies of neighboring countries.

Historical Performance Benchmarks: Previous Year Cut-off Analysis

The 2021 recruitment cycle serves as the most relevant benchmark for the 2026 examination. The cut-off marks are released office-wise and category-wise, reflecting the competitive density of each region.

Regional Office | General/UR | OBC | SC | ST | EWS |

Ahmedabad | 96.5 | 81.75 | - | 81 | 75.5 |

Bengaluru | 83.75 | - | 83.75 | - | 67 |

Bhopal & Raipur | 105.75 | - | - | 82 | 103.25 |

Bhubaneswar | 105.75 | 103.5 | 104.75 | 85.75 | 98.75 |

Chandigarh | 110 | 104 | 103 | - | 104.5 |

Chennai | 92 | 89 | - | - | 71 |

Guwahati & NE | 92.5 | 88.25 | - | 88.5 | 63.25 |

Hyderabad | 103.25 | 102.75 | 99.75 | 100.75 | 97.75 |

Jaipur | 108.25 | 105.5 | - | 101.25 | 104.5 |

Kanpur & Lucknow | 111.25 | 104.25 | - | - | 108 |

Kolkata | 106 | 102.5 | 103.75 | - | 98.5 |

Mumbai | 92.75 | 86.25 | - | 85.25 | 79 |

New Delhi | 105 | 102.75 | - | - | 100.5 |

Patna & Ranchi | 110.25 | 108 | - | - | 109 |

The data indicates that candidates in regions like North India (Chandigarh, Jaipur, Kanpur/Lucknow) must target scores in excess of 110 out of 120 due to the immense volume of applicants in the Hindi heartland. Conversely, regions with specific local languages like Mumbai (Marathi/Konkani) or Guwahati (Assamese/Khasi/Manipuri) show slightly more accessible cut-offs, highlighting the strategic importance of the LPT as a filter.

Compliance and Documentation Standards

The RBI employs a sophisticated online application portal that requires precise digital compliance. Candidates must ensure that their uploaded documents meet the following specifications to avoid technical rejection.

Digital Imaging Specifications

Photograph: Recent passport-size color photograph (4.5 cm x 3.5 cm) on a light background. File size must be between 20 KB and 50 KB.

Signature: Must be on white paper with a black ink pen. Signatures in capital letters are strictly prohibited. File size: 10 KB to 20 KB.

Left Thumb Impression: On white paper with blue or black ink. File size: 20 KB to 50 KB.

Handwritten Declaration: Must be written in English on white paper with black ink. The text must be: “I, _______ (Name of the candidate), hereby declare that all the information submitted by me in the application form is correct, true and valid. I will present the supporting documents as and when required.” File size: 50 KB to 100 KB.

Candidates must also be prepared to present original valid ID proof (Aadhar Card, PAN Card, Voter ID, etc.) along with the call letter at the time of the examination.

Directives and General Instructions

The Bank enforces several non-negotiable instructions to maintain the sanctity of the recruitment drive.

Singularity of Application: A candidate is permitted to apply to only one RBI office. Submitting multiple applications will lead to the rejection of all applications or the acceptance of only the most recent one (without fee refund for previous ones).

Exam Center Jurisdictions: Candidates must choose an examination center within the same state where the recruiting office is located. For example, a candidate applying for the Mumbai office cannot choose an exam center in New Delhi.

Over-Qualification Penalty: The "undergraduate" status is a mandatory condition. If at any stage - even after joining - it is discovered that a candidate was a graduate at the time of application, their appointment will be terminated immediately.

Biometric Verification: The Bank may capture biometric data (thumb impression or iris scan) at the examination venue to prevent impersonation.

Procedural Roadmap: How to Apply

The application process is handled through the official website and involves several stages.

Phase I: Registration: Access the RBI official website (rbi.org.in), navigate to the "Opportunities@RBI" section, and click on "Current Vacancies." Select the "Recruitment for the post of Office Attendant - Panel Year 2025" link.

Phase II: Personal Profile: Click on "Click Here for New Registration." Enter your full name, a valid mobile number, and an active email ID. A provisional registration number and password will be generated and sent via SMS and email.

Phase III: Academic and Professional Detail: Log in with the provided credentials. Fill in details regarding your 10th-standard passing year, board, and marks. Select the regional office you wish to apply for, ensuring you meet the domicile and linguistic requirements.

Phase IV: Document Upload: Upload the scanned photograph, signature, thumb impression, and handwritten declaration following the size specifications meticulously.

Phase V: Preview and Payment: Review the entire application. Once submitted, details cannot be changed. Proceed to the payment gateway and pay the category-wise fee.

Phase VI: Confirmation: Download the application printout and the payment e-receipt. These are essential for future stages of the recruitment process.

Strategic Preparation and Bibliographic Recommendations

Success in the RBI Office Attendant examination is highly dependent on speed and accuracy. The "easy to moderate" difficulty level means that the cut-offs are high, leaving no room for error.

Expert Bibliographic List

The following resources are recommended by domain experts for comprehensive section-wise preparation:

Section | Recommended Title | Author / Publisher |

Reasoning Ability | A Modern Approach to Verbal and Non-Verbal Reasoning | R.S. Aggarwal |

Reasoning Ability | Analytical Reasoning | M.K. Pandey |

Numerical Ability | Quantitative Aptitude for Competitive Examinations | R.S. Aggarwal |

Numerical Ability | Fast Track Objective Arithmetic | Rajesh Varma (Arihant) |

General English | Objective General English | S.P. Bakshi (Arihant) |

General English | Word Power Made Easy | Norman Lewis |

General Awareness | Lucent’s General Knowledge | Lucent Publications |

General Awareness | Banking Awareness | Arihant Experts |

Preparation Strategy

Foundation Phase: Spend the first two weeks clarifying concepts in arithmetic (percentages, ratios) and reasoning (syllogism, coding). Use YouTube resources such as "Maths by Arun Sir" or "Reasoning by Arpit Sir" for conceptual clarity.

Practice Phase: Solving memory-based papers from the 2021 cycle is non-negotiable. These provide a realistic view of the question difficulty and topic weightage.

Mock Test Phase: In the final 15 days, attempt at least one full-length mock test daily. Platforms like Adda247 or Guidely provide interfaces that mimic the actual exam software.

Sectional Balance: Do not neglect the General English and General Awareness sections. These are time-savers that can provide a significant boost to the overall score.

Official Notice and Link Infrastructure

To ensure the security and authenticity of the application process, candidates must only use official institutional links.

Official Recruitment Portal: Click Here

Notification PDF Access: Click Here

Online Registration Link: Click Here

How to Apply: Click Here

Instructions for candidates: Click Here

Guidelines for Scribe: Click Here

Instructions for scanned photo document upload at the time of Registration: Click Here

Career Outlook

The RBI Office Attendant Recruitment 2026 represents a critical entry point for individuals seeking a stable, prestigious, and financially rewarding career in India’s central bank. For the 572 successful candidates, the role offers far more than an entry-level salary; it provides a comprehensive socio-economic safety net through medical benefits, housing assistance, and concessional loans. The "undergraduate rule" creates a level playing field for those with 10th-standard qualifications, ensuring that the institution’s foundational tier remains accessible to its target demographic.

Furthermore, the promotion hierarchy within the RBI allows an Office Attendant to eventually transition into officer-grade positions through internal exams and consistent performance. This potential for vertical mobility makes the 2026 recruitment drive a strategic milestone for young aspirants. As the February 28, 2026, examination date approaches, candidates are encouraged to focus on speed, precision, and regional linguistic mastery to secure their place in one of the world’s most respected financial institutions.

Join our WhatsApp and Telegram Channels

Get Knowledge Gainers updates on our WhatsApp and Telegram Channels